.svg)

Please note that 'Variables' are now called 'Fields' in Landbot's platform.

When we think of loan calculations, interest rates, and so forth, we don't usually think of chatbots.

However, it’s not a secret that many users are not precisely fond of filling out online forms, after which they have to wait at least 24 hours to get their quote.

By not providing your prospects with a pleasant as well as an efficient way to get a simple calculation, you are risking losing business.

But what if you could make your loan calculator conversational and responsive in real-time?

Chat format is perhaps the most common and natural way of online communication on any device. Though, it’s particularly comfortable on mobile.

You might be thinking that building a chatbot that can calculate loans or interests is way out of your league skill or budget-wise. I’m here to tell you that’s not true.

No-code tools like our Landbot are removing these types of boundaries from the equation. In fact, you can create the whole conversational and calculation flow with Landbot without ever leaving the builder. With a few of our Formulas, we can let our bot do the heavy lifting and become the difference between potential clients fulfilling their needs right away or having to wait for a custom proposal to come to their inbox.

Why Have an Interest Rate Bot?

An interest rate bot or a loan bot can cater to each individual client instantly, giving them the information and quotes specific to their situation in real-time.

Let's say you're trying to sell cars and offering potential clients the option to trade in their current car. Now, maybe they're trading in a car from the 80's that's on its last breath; or, just maybe they're downsizing and trading in a newer BMW.

The point is, there's no one size fits all for loans, and I'll be honest, if I'm required to enter my email address to have a potential interest rate come to my inbox, I'll say no every time.

So that's the goal, to have an accurate, immediate loan calculator that won't cause our potential clients to lose interest before the proposed rate even comes to their inbox. If it ever does...

How to Build a Chatbot Loan Calculator without Coding?

In this tutorial, I will show you how to use Landbot to create the conversational flow and calculate the quote for your client using one of our top features, Formulas.

The bot will ask all the pertinent questions, and with a series of Formulas and Variables, we'll do some calculations that will return the numbers we want in a legible format.

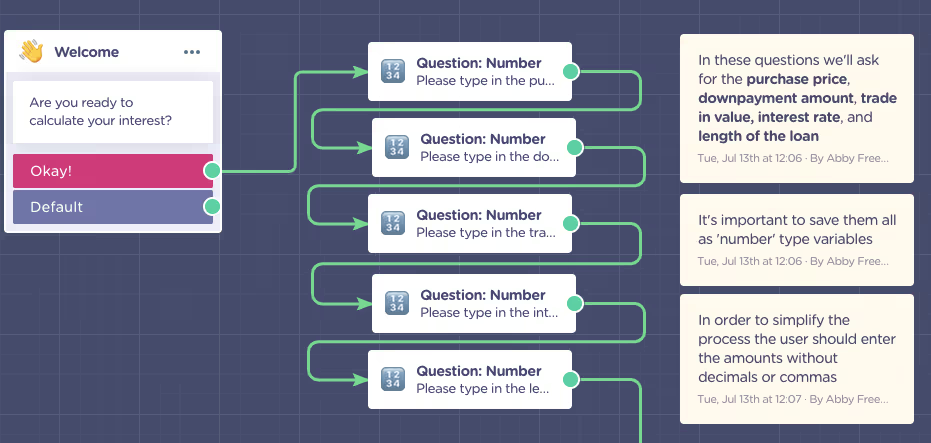

Before I explain everything block by block, here is an overview of the bot:

1. Familiarize Yourself with Landbot

Landbot users, skip to the next section! Though, if this is your first touch with our platform, you might want to take a moment and familiarize yourself with the chatbot builder.

Landbot is a no-code, drag-and-drop conversational builder interface, allowing you to create rule-based or NLP chatbots at a fraction of the cost or time it usually takes to make a bot.

It works on a system of blocks connected by arrows. Each block comes with its own functionalities and format settings.

Blocks like the Buttons block, Picture Choice, or Rating improve the front-end experience of the user.

While other blocks like native 3rd-party integrations, Conditional Logic or Formulas, allow the magic to happen on the back-end, hidden from the user’s view.

2. Select Your Pricing Questions

Before you start working on your bot, make sure you have your questions lined up.

When building your own bot, you might want to include a bit more chit-chat and personality. Though, for the purposes of this tutorial, I went straight to the point.

Once the user agrees to the proposal in the Welcome message, the bot proceeds to ask five questions pertaining to the calculation:

As you may have noticed, I chose the “Question: Number” type of block. It’s a pre-formatted block that only accepts numeric characters as responses. I used it to prevent the users from entering extra characters that could throw off our calculations. Here is what I asked for:

- Purchase price

- Down payment amount

- Trade-in value

- Interest rate

- Length of loan

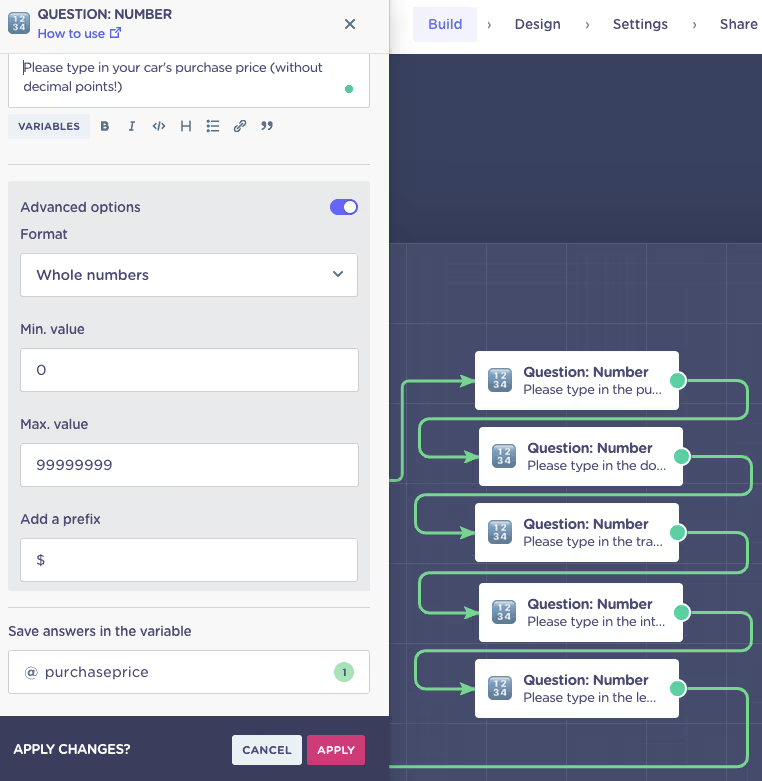

When you click on the question block, a block editor will pop up on the left side of the screen. Besides formulating the question, here you are able to determine the other “rules” for the block, such as:

- Number format

- Minimum and maximum value acceptable

- Currency

- Variable under which to save the user response

Make sure you name your variable appropriately, is you can quickly identify its origin and avoid confusion in your calculations. Also, make sure you save the variable in the numeric format:

3. Intro To Formulas

If this is your first time working with Formulas, don’t miss this little intro.

I know they can seem a little daunting at first, but the Formulas block is not much different from the formulas you use in Excel. Once you learn to use them, there are virtually no limits to what your bot will be able to do.

This bot will use five types of Formulas in total.

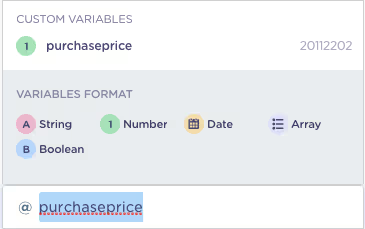

4. How much the Client will Owe: Formulas One & Two

The first two Formulas will calculate the amount the client will owe after they've traded in their current car and after the downpayment:

First Formula:

To find out the upfront cost, before the downpayment, we'll subtract the trade-in value (Y) from the purchase price (X), we'll save it in a number type.

Upfront = X-Y

Subtract(@purchaseprice, @tradeinvalue)

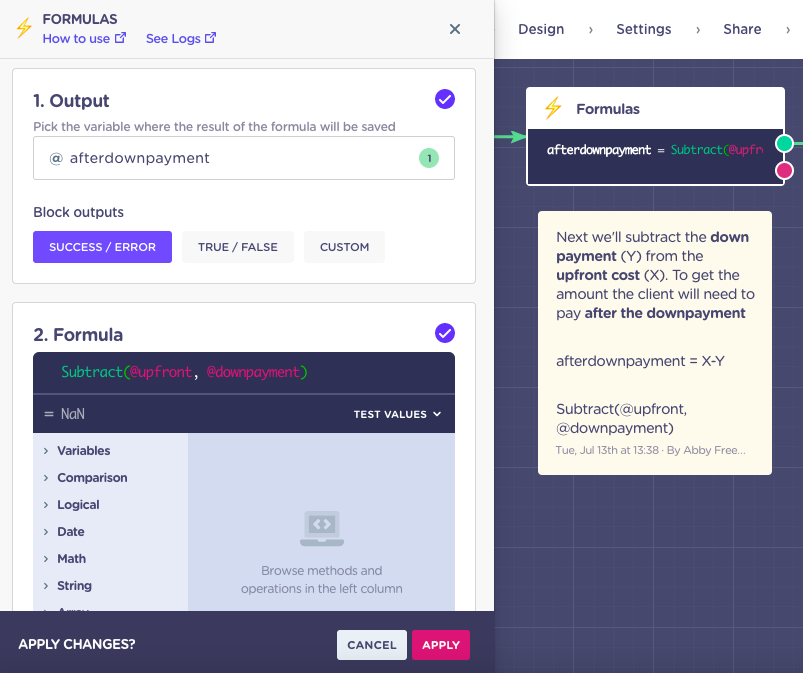

Second Formula:

Next, we'll subtract the down payment (Y) from the upfront cost (X) to get the amount the client will need to pay after the downpayment:

afterdownpayment = X-Y

Subtract(@upfront, @downpayment)

5. Calculating the Interest: Formula Three

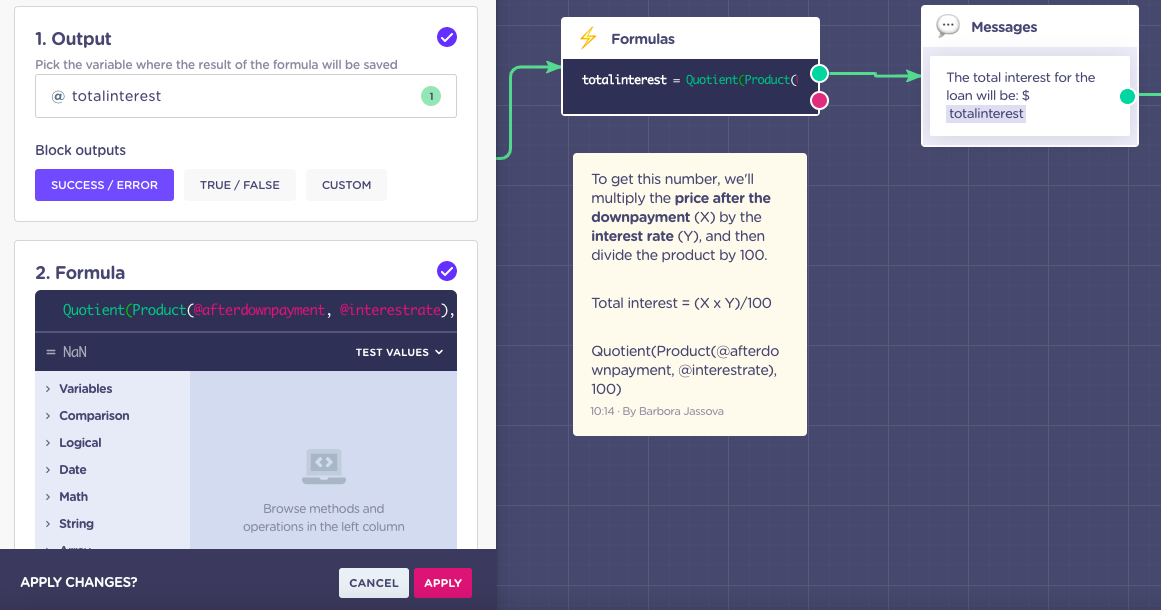

We'll then find out the total amount of interest that will be charged.

If, for example, the interest rate is 10% and the price after downpayment is 10,000, the total amount of interest charged would be 1,000.

To get this number, we'll multiply the price after the downpayment (X) by the interest rate (Y), and then divide the product by 100.

Total interest = (X x Y)/100

Quotient(Product(@afterdownpayment, @interestrate), 100)

6. Monthly Payment: Formulas Four & Five

In the last two formulas, we'll calculate the monthly payment amount and then present it in a legible format.

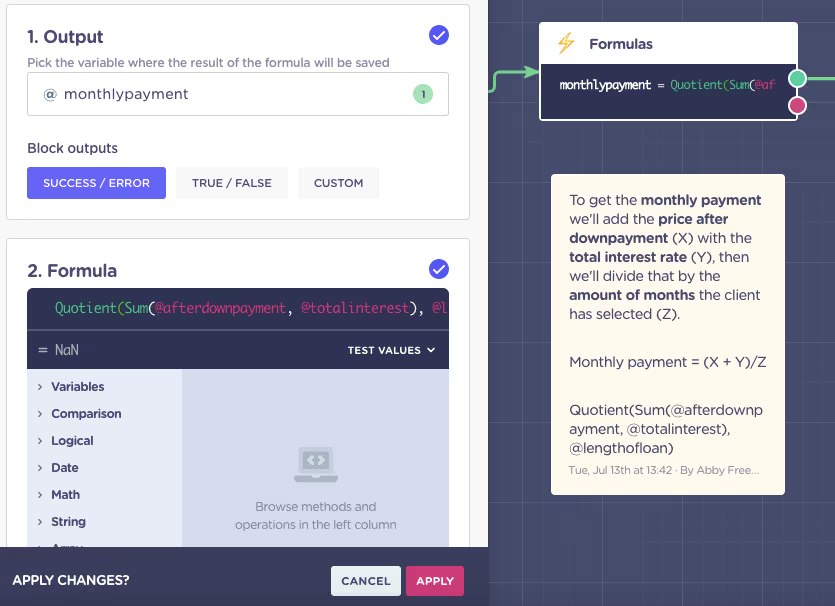

Formula four:

To calculate the monthly payment, sum the price after downpayment (X) with the total interest rate (Y). Then, divide that by the number of repayment months the client has selected (Z):

Monthly payment = (X + Y)/Z

Quotient(Sum(@afterdownpayment, @totalinterest), @lengthofloan)

Formula five:

The last thing we'll do is trim the numbers after the decimal point of the monthly payment (X), to display a whole number:

Trunc(X)

Trunc(@monthlypayment)

And you are done!

Here is how the experience looks like on the front-end:

How Do You Adjust it for Your Use Case?

Maybe you have a fixed interest rate? Perfect! Then we'll just remove the question type and add a set variable with the fixed rate instead.

Truth be told, once you have a basic understanding of how the Formulas work, you can make any kind of modification you need to. The sky is the limit!

BUT! The customization doesn’t stop with Formulas. You can bring other Landbot features into the mix and perhaps send the prospect email notification with their calculation so they can review it later. All you need to do is add an email question and a send-an-email block which will trigger an automated email with all the info straight from the bot. Similarly, you can take advantage of 3rd-party integration and export lead data to a Google spreadsheet or any other CRM database.

There are truly no limits to personalizing your real-time loan calculator.

Try your hand at building your own now!

.avif)

.avif)

%20(1).png)

.avif)

%20(1).png)

%20(1).png)